Reframing incentives for climate policy action J.-F. Mercure orcid.org/0000-0003-2620-92001,2,3, P. Salas orcid.org/0000-0003-4046-23762,4, P. Vercoulen orcid.org/0000-0002-2468-55131,3, G. Semieniuk orcid.org/0000-0002-2747-595X5,6, A. Lam2,7, H. Pollitt orcid.org/0000-0002-0507-32202,3, P. B. Holden8, N. Vakilifard8, U. Chewpreecha3, N. R. Edwards orcid.org/0000-0001-6045-88042,8 & J. E. Vinuales2 Nature Energy (2021)Cite this article A key aim of climate policy is to progressively substitute renewables and energy efficiency for fossil fuel use. The associated rapid depreciation and replacement of fossil-fuel-related physical and natural capital entail a profound reorganization of industry value chains, international trade and geopolitics. Here we present evidence confirming that the transformation of energy systems is well under way, and we explore the economic and strategic implications of the emerging energy geography. We show specifically that, given the economic implications of the ongoing energy transformation, the framing of climate policy as economically detrimental to those pursuing it is a poor description of strategic incentives. Instead, a new climate policy incentives configuration emerges in which fossil fuel importers are better off decarbonizing, competitive fossil fuel exporters are better off flooding markets and uncompetitive fossil fuel producers—rather than benefitting from ‘free-riding’—suffer from their exposure to stranded assets and lack of investment in decarbonization technologies. The adoption of the Paris Agreement in 2015 set a worldwide objective of keeping the global average temperature well below 2 °C above pre-industrial times, with efforts to achieve 1.5 °C (ref. 1), and called for clearer scientific evidence of the impacts of a 1.5 °C pathway2. New energy and climate scenarios have been developed to provide such evidence2,3,4,5,6. Net-zero emissions targets have since been adopted for 2050, notably in the European Union, the United Kingdom, Japan and South Korea, and for 2060 in China, which together imply substantial reductions in global fossil fuel use and large markets for low-carbon technology. Reducing emissions requires increased investment in low-carbon technology, with much debated macroeconomic implications7,8,9,10. Large quantities of fossil fuel reserves and resources are likely to become ‘unburnable’ or stranded if countries around the world implement climate policies effectively11,12,13. The transition is already underway, and some stranding will happen, irrespective of any new climate policies, in the present trajectory of the energy system, with critical distributional macroeconomic impacts worldwide10. Although concerns over peak oil supply have shaped foreign policy for decades, the main macroeconomic and geopolitical challenges may, in fact, result from peaking oil (and other fossil-fuel) demand14,15,16,17,18.Climate action has traditionally been framed as economically detrimental to those who pursue it. From this perspective, climate action taken by a country is plagued by ‘free-riding’ by others not taking it, who nevertheless benefit from global mitigation, without the economic burden of environmental regulation19,20,21,22. However, this motive is not supported by the evidence23,24. More fundamentally, the nature of strategic incentives is misrepresented by this framing: incentives may now be more about industrial strategy, job creation and trade success25,26,27. The costs of generating solar and wind energy, which depend on location, have already or will soon reach parity with the lowest-cost traditional fossil alternatives15,28,29, and investment in low-carbon technologies is generating substantial new employment30,31,32.The notion that a country should benefit from free-riding on other countries’ climate policies can also be challenged. Incremental decarbonization, increasing energy efficiency and the economic impacts of COVID-19 have led oil and gas demand and prices to decline substantially. This has affected the viability of extraction in less competitive regions15, despite new fossil fuel subsidies in recovery packages33, although the recovery has been rapid and generated substantial market uncertainty. Fossil fuel exporters can be economically impacted by the climate policy decisions of other countries through a lower global demand and lower prices, and abandoning climate policies to boost domestic demand or maintain high prices is not sufficient to compensate for declining exports10.In this article, we question the traditional framing of climate policy and explore the emergence of a new incentives configuration. We find that positive payoffs may arise for fossil energy importers who reduce imports, whereas negative payoffs arise for energy exporters who lose exports, both being far larger than the actual costs of addressing climate change.The transition to a low-carbon economy has raised major questions of geopolitics in the international relations literature16,17,18,34,35,36. Here we adopt Vakulchuk’s definition of ‘geopolitics’, as the connection between geography, resources, space and the power of states36. It has become increasingly clear, with the pace at which renewables are growing, that traditionally fossil-fuel-dominated energy geopolitics must be revisited. With the prospects of renewable energies capturing markets previously dominated by fossil fuels, energy commodity exporters, in some cases affected by the resource curse37, lose export markets. Concurrently, importers improve their trade balances16,17. Revenue losses could lead to political instability in fossil-fuel-exporting economies and, although robust evidence indicates that climate change will increase conflict at all scales38, it is unclear whether the transition will increase or reduce conflict overall16,35,36.Bazilian, Goldthau and co-workers34,39 describe four scenarios of geopolitical evolution, based on whether successful climate action is taken and on how geopolitical rivalries in fossil fuels and renewables are addressed. They call for short- to mid-term quantitative scenario creation that could describe the geopolitical dynamics and narrow down the possibilities. A key question is whether low-carbon-technology development is globally cooperative or fragmented, and whether the emerging renewable energy geopolitics comes to replace fossil energy geopolitics18,40.Most nations possess sizeable technical potentials for one or more types of renewable energy sources, which reduces the likelihood of any state gaining important control over future energy supplies41. However, the production of renewables technology is increasingly concentrated in a few regions, which include China, Europe and the United States, and generate new types of geopolitical rivalry17,18. Concerns over access to critical materials to manufacture renewables technology have been raised41 and, although debated, remain a concern for policymakers. Lastly, the possibility of new resource-curse situations linked to renewables has also been also raised18.Scholarship in geopolitics thus paints a much more complex picture than the standard framing of climate action as an environmentally necessary but economically costly step. Despite this, the prevailing framing22,23,42 underpins important debates, such as those on ‘carbon leakage’ (the relocation of carbon-intensive industries to countries with no or limited climate policy), the historical ‘free-riding’ of developed nations and the right to emit of developing nations. Hypotheses over geopolitics urgently need to be better supported by quantitative modelling evidence to help narrow down the possibilities.Understanding quantitatively the economic impacts of the ongoing low-carbon transition and their geopolitical implications requires modelling tools suitable for projecting sociotechnical evolution. Here we used the E3ME-FTT-GENIE integrated framework (E3ME, energy–economy–environment macro econometric; FTT, future technology transformation; GENIE, grid enabled integrated Earth)10 of disaggregated energy, economy and environment models based on the observed technology evolution dynamics and calibrated on the most recent time series available (Methods). Loosely consistent with Goldthau and co-workers34,39, we created four scenarios from 2022 to 2070, which depict how future energy production, use, trade and income could either underpin expectations or actually materialize. We projected changes in output, investment and employment in 43 sectors and 61 regions of industrial activity, coupled with bilateral trade relationships between regions and input–output relationships between sectors. We simulated endogenous yearly average oil and gas prices and production over 43,000 active oil and gas assets worldwide. We then used a simple game theory framework to identify possible geopolitical incentives.Technology diffusion trajectory: We simulated the current trajectory of technology and the economy, based on recently observed trends in technology, energy markets and macroeconomics, and explored the direction of technology evolution irrespective of new climate policies. This generates a median global warming of 2.6 °C.Net-zero CO2 globally in 2050: We added new detailed climate policies by either increasing the stringency of what already exists or by implementing policies that may be reasonably expected in each regional context. The United Kingdom, European Union, China, Japan and South Korea reach net-zero emissions independently in 2050. Moderate amounts of negative emissions are used to offset residual emissions in industry. This achieves a median warming of 1.5 °C.Net-zero in Europe and East Asia: We used the same policies to achieve net-zero emissions for Europe and East Asia (China in 2060, and Japan, the European Union and South Korea in 2050), but assume technology diffusion trajectory (TDT) policies elsewhere. This achieves a median warming of 2.0 °C.Investment expectations: We replaced our energy technology evolution model by exogenous final energy demand data from the International Energy Agency (IEA) World Energy Outlook 2019 current policies scenario43, in which energy markets grow over the simulation period, to reflect the expectations of delayed or abandoned decarbonization by a major subset of investors in energy systems. This generates warming of 3.5 °C.Figure 1 shows the evolution of technology globally for electricity generation, passenger road transport, household heating and steelmaking, as modelled using the FTT model components, and covers 58% of the global final energy carrier use, and 66% of global CO2 emissions. Global fuel combustion and industrial emissions in all sectors are also shown.Fig. 1: Diffusion of technology and evolution of energy use and emissions in key sectors.The evolution of 88 key power generation and final energy use technologies and emissions in four scenarios. Contributions are aggregated for clarity. Dashed lines indicate totals from other panels in the same rows, as guides to the eye for comparison. Adv, advanced; BF, blast furnace; BOF, basic oxygen furnace; CCS, carbon capture and storage; DR, direct reduction; EAF, electric arc furnace; MOE, molten oxide electrolysis, SR, smelt reduction.We observe that the investment expectation (InvE) baseline sees coal and natural gas use dominate power generation, and petrol and diesel use in road transport translate into a steady growth of oil demand, whereas technology remains relatively unchanged for heating and steelmaking and other parts of the economy. Note that the InvE scenario projection is not likely to be realized as it features substantially lower than already-observed growth rates in solar, wind, electric vehicles (EVs) and heat pumps (Supplementary Note 1).In stark contrast, the TDT scenario projects a relatively rapid continued growth, at the same rates as observed in the data, of some low-carbon technologies (solar, wind, hybrids and EVs, heat pumps and solar heaters), whereas others continue their existing moderate growth (biomass, geothermal, hydroelectricity and compressed natural gas (CNG) vehicles). Some technologies have already been in decline for some time, such as coal-based electricity and diesel cars (United Kingdom, European Union and United States), coal fireplaces and oil boilers in houses, and some inefficient coal-based steelmaking technologies (most countries).Through a positive feedback of learning-by-doing and diffusion dynamics (Extended Data Fig. 1), solar photovoltaics (PV) becomes the lowest-cost energy generation technology by 2025–2030 in all but the InvE scenario, depending on regions and solar irradiation. EVs display a similar type of winner-takes-all phenomenon, although at a later period. Heating technologies evolve as the carbon intensity of households gradually declines. The trajectory of technology in the TDT scenario, as observed in recent data, suggests that primary energy consumed in the next three decades is substantially lower than that suggested by InvE, as the relatively wasteful and costly thermal conversion of primary fossil fuels into electricity, heat or usable work stops growing even though the whole energy system continues to grow. In the Paris-compliant net-zero CO2 globally in 2050 (Net-zero) scenario, technology transforms at a comparatively faster pace to reach global carbon neutrality, whereas in the E

https://www.nature.com/articles/s41560-021-00934-2

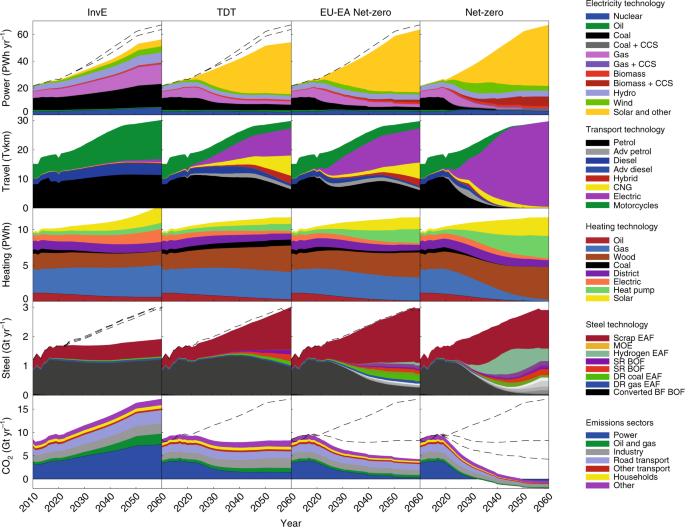

Reframing incentives for climate policy action